It’s easy to score overloaded in debt, however, debt consolidating has the benefit of a solution. Bankrate’s debt consolidating calculator is designed to help you know if debt consolidation ‘s the right circulate to you personally. Just complete your the financing quantity, bank card balance and other costs. Then see just what this new payment per month would-be which have good consolidated mortgage. Is adjusting brand new conditions, mortgage designs otherwise price until you find a debt settlement plan that meets your goals and you can budget.

Debt consolidating involves consolidating multiple expense on you to brand new mortgage. The goal is to improve money, down interest, and repay financial obligation quicker. Bankrate’s debt consolidation calculator was designed to help you determine if debt consolidating is the right move to you personally.

Complete their outstanding mortgage number, bank card balances or other expenses to see what your month-to-month commission you will feel like. Was modifying the new terms, mortgage products or price if you don’t pick a debt settlement package that suits your goals and you can funds.

5 a way to combine debt

Once you work at the latest amounts, like an approach to consolidate your debt. You can find pros and cons to each choice and, of course, you will need to check around for financial products to make sure you will be obtaining the best rates and you may terms.

Just remember that , debt consolidation is not suitable everyone. You should merely consolidate the debt for folks who qualify for an effective lower interest than simply youre already using. It is also crucial that you observe that only some form of personal debt will likely be consolidated.

1. Signature loans

A personal loan was an unsecured loan that, in place of a charge card, has actually equivalent monthly obligations. Mortgage quantity are different which have credit history and record, however, essentially best away during the $100,000. Whenever you are banks and you may credit unions render personal loans, subprime lenders also are most active contained in this industry, therefore store carefully and you will examine rates, terms and conditions and you will fees anywhere between around three or higher loan providers.

Because an unsecured loan try unsecured, there are no assets on the line, it is therefore recommended for a debt settlement financing. Although not, remember that a large mortgage with the lowest Apr demands good credit. Here are some most readily useful signature loans for debt consolidation and you can examine lenders to discover the best consumer loan price for you.

2. Household equity financing otherwise personal lines of credit

Due to the fact a citizen, you can make use of the fresh new collateral of your home in order to consolidate the personal debt. While the house guarantee money and credit lines (HELOCs) enjoys lower interest rates, they might cost not so much than just a personal bank loan otherwise balance transfer bank card. Although not, delivering lengthy to repay your loan you will definitely imply spending much more for the appeal.

Domestic guarantee funds is a dangerous types of debt consolidation. If you fail to pay off the borrowed funds, you could eradicate your house to foreclosures.

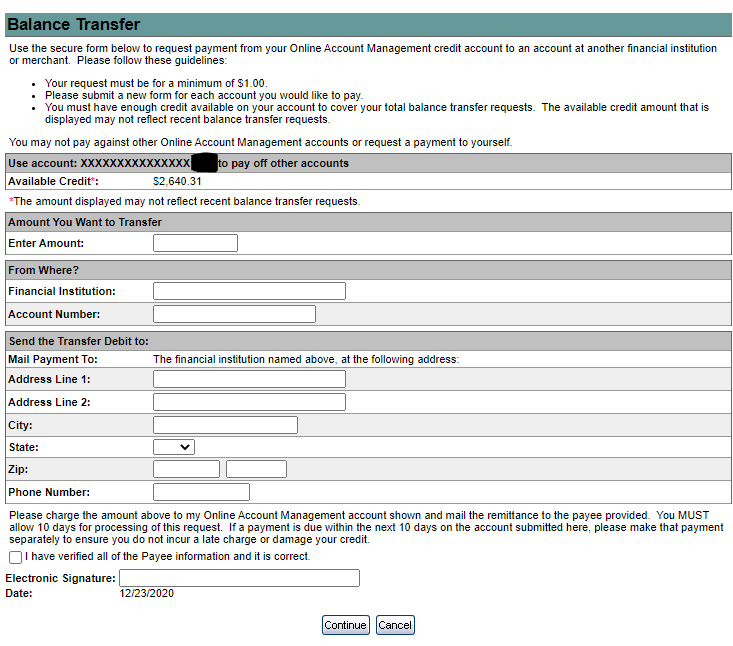

3. Charge card transfers of balance

Animated your debt to one personal bad credit loans Louisiane charge card, known as credit cards harmony transfer, could save you money on interest. The fresh new credit will demand a limit sufficient to match your own balances and an annual percentage rate (APR) lowest adequate to make integration worthwhile.

Getting an unsecured credit assurances you’ll not chance people assets. Before applying, ask about equilibrium import limitations and you may fees. Plus, you usually wouldn’t find out the Apr otherwise credit limit up to immediately following and unless you are recognized.

On a single mastercard due to the fact repository for all your credit financial obligation is actually fighting fire which have flame, very be mindful if this sounds like the policy for debt consolidating. Once you have transferred bills to a single cards, work with using one credit off as quickly as possible – and prevent wracking up most personal debt in your most other cards.

4. Discounts otherwise later years account

- Bank account: You are able to your own savings to settle every otherwise an effective part of your debt. It may possibly not be the leader. If you obtain away from deals, you are left rather than an emergency finance to pay for unexpected expenses subsequently.

- 401(k): Of numerous 401(k) preparations enables you to borrow secured on pension discounts within a good relatively low interest. But if you prevent your task otherwise get fired, the whole 401(k) financing gets due instantly. Even if you is actually safe on your own work, discover a ten percent punishment added if you fail to pay back and you’re below decades 59.5.

- Roth Personal Retirement Account: There’s absolutely no punishment to have borrowing exactly what you deposited in your Roth IRA, but you will desire to be certain that merging financial obligation outweighs the brand new shed dominating and you can substance desire.

5. Personal debt administration plans

If you need debt consolidation reduction choices that don’t want taking right out financing, trying to get a new credit otherwise experiencing coupons or old-age account, a loans management plan will probably be worth given. That have a debt administration plan, it is possible to work with a beneficial nonprofit credit counseling agencies to discuss with loan providers and you may write a plan to pay your financial situation.

Your personal all of the charge card levels while making you to definitely payment with the agencies, and therefore will pay the fresh new creditors. You will still receive all of the charging comments from your own creditors, therefore it is very easy to track how quickly your debt will be repaid.

Particular businesses will get work with low or no cost when you’re enduring your finances. Stick to nonprofit firms affiliated with the new Federal Basis having Borrowing Guidance or even the Financial Guidance Organization regarding The united states, and make sure your debt specialist are authoritative through the Council to your Certification.

Normally debt consolidation damage my personal credit history?

Debt consolidating financing can also be harm your credit rating, nevertheless the perception is frequently short term. Making an application for the loan concerns a difficult credit score assessment, which can miss your get by a number of products, predicated on FICO.