The brand new Grameen Bank’s microfinance design, founded of the Muhammad Yunus, is actually described as multiple secret values intended for empowering the poor, like female, through economic introduction

The new ICICI Bank v. Subhash Verma situation enjoys significant implications towards the Indian financial market, especially in regards to regulating practices, chance government, together with competitive land. This example highlights the necessity for banking companies to stick to strict regulating frameworks if you find yourself dealing with their working threats effectively. Next sections hard in these implications. ## Regulating Conformity and you will Governance – The situation underscores the importance of sturdy regulating compliance components within banking institutions, concentrating on the need for adherence to banking laws to make sure financial stability. – It portrays the character of regulatory authorities in enforcing conformity, that’s crucial for maintaining field ethics and you can protecting stakeholders. ## Chance Administration Strategies – The outcome emphasizes the necessity for active advantage-responsibility management (ALM) to help you mitigate dangers associated with the interest rate activity. – Banking institutions should adopt comprehensive chance government strategies to boost their resilience facing market volatility, given that exhibited of the ICICI Bank’s strategies. ## Competitive Fictional character – Your situation may influence the new aggressive landscaping of the compelling finance companies in order to reevaluate its operational actions and you may support service ways to manage field share. – Mergers and you may acquisitions, because the observed in the brand new financial industry, can be a proper a reaction to improve performance and you can stockholder well worth, as confirmed because of the performance improvements post-merger. In contrast, once the case encourages regulatory vigilance, it may also lead to enhanced working prices for banks, probably affecting their profitability and competitive line in the industry.

Mobile banking improves strength to economic surprises giving house and people that have increased entry to financial features, permitting most readily useful risk administration and you may monetary balances. Listed here are trick issues illustrating it change in resilience. ## The means to access Economic Characteristics – Mobile financial programs, particularly Meters-Shwari in the Kenya, bring digital funds that enable domiciles to view borrowing rapidly, reducing the probability of forgoing extremely important costs during bad unexpected situations because of the 6.3 commission things. – New extension regarding mobile currency features enables house in order to make purchases, save yourself, and you will upload remittances, which improves the financial flexibility and you can coverage. ## Exposure Minimization – Mobile money incorporate is proven to help you dampen this new feeling out of economic unexpected situations, for example rainfall motion, to your home practices and you will economic craft, and therefore stabilization money profile. – Distance so you’re able to cellular currency agents correlates seriously having family strength, demonstrating you to definitely much easier entry to these services normally notably raise good household’s capability to endure shocks. ## Team Type – Providers implementing cellular payment innovation statement improved transformation and lower personal suspicion out-of future conversion, which leads to total economic strength. Alternatively, whenever you are cellular financial significantly advances strength, that isn’t an extensive substitute for all the economic weaknesses. Structural things from inside the borrowing from the bank segments and you can varying quantities of electronic literacy is also limit the functionality of these financial equipment in certain contexts.

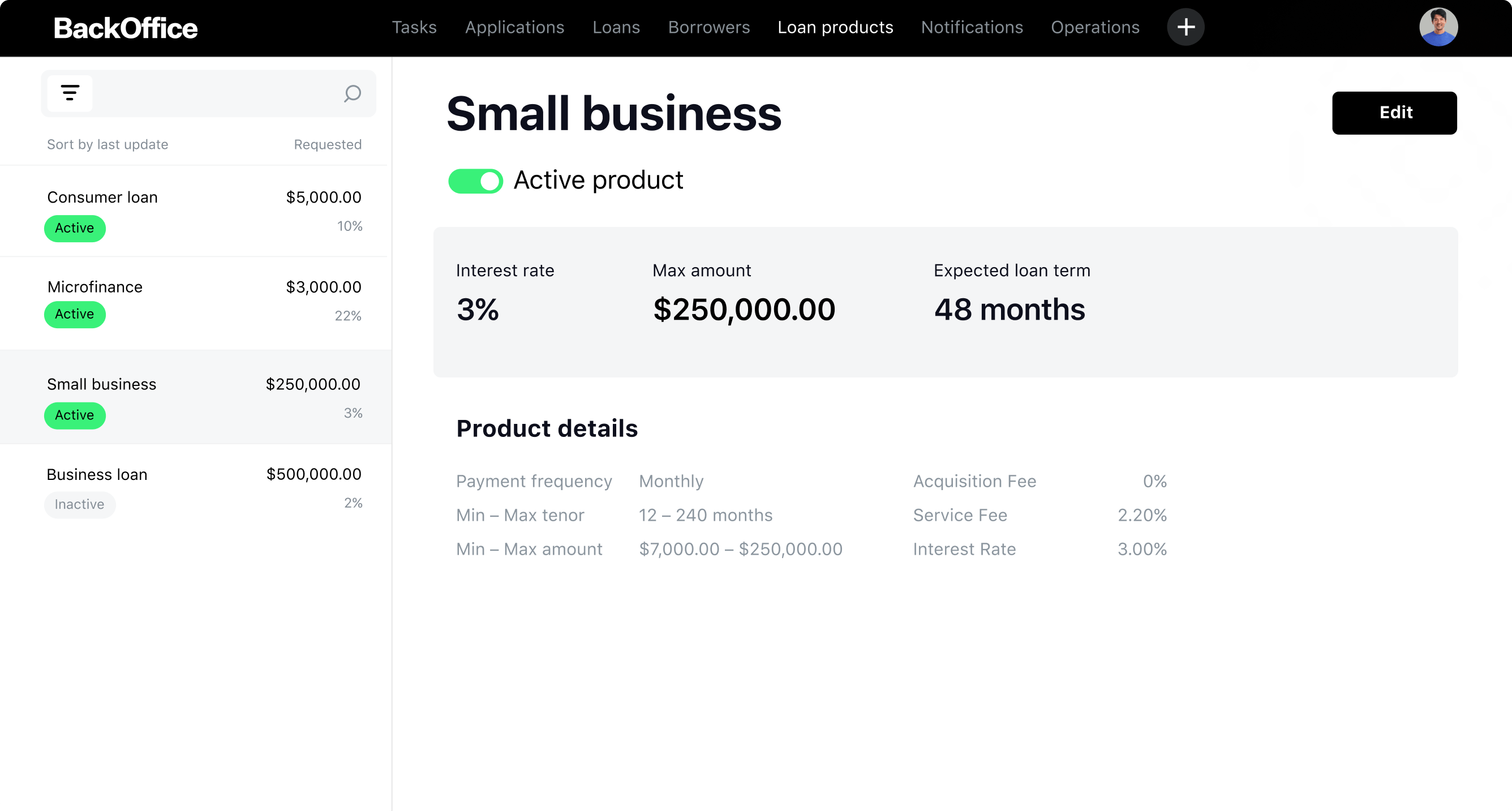

Visualization takes on a vital role within the mortgage approval process by the enhancing decision-and also make and you may risk evaluation. From the visualizing the advantages out of risk internet mortgage suggestions, establishments can make bequeath charts to spot and block unlawful financing pointers dissemination. Approvals possibilities make the most of graphic screen actions that identify and you can display screen acceptance process advice, simplifying the comprehension of cutting-edge processes and you will improving efficiency. Simultaneously, visualizing service streams thanks to static screen charts aids in displaying recognition improvements to applicants, making sure transparency and you may facilitating communications ranging from individuals and you can approvers. Leveraging visualization units and methods will help loan providers improve mortgage acceptance techniques, increase risk management, while making informed choices predicated on research-passionate knowledge.

Next parts details the latest center standards of your Grameen Financial design

It design could have been extensively implemented worldwide, proving its capabilities in relieving poverty and you may fostering entrepreneurship. ## Concentrate on the Poor – Grameen Bank particularly targets the fresh new extremely terrible, ensuring that those with at least info get access to financing, as opposed to conventional financial techniques. – It has got supported more nine billion readers across the 81,678 towns during the Bangladesh, focusing on the detailed started to and you may commitment to monetary inclusion. ## Category Financing Device – The latest model employs a team financing strategy, in which borrowers setting quick communities to guarantee for each other’s money, cultivating accountability and you may reducing default loans Florence costs. – This product encourages public cohesion and you can shared assistance certainly one of individuals, improving its likelihood of victory. ## Emphasis on Feminine Empowerment – Grameen Lender prioritizes lending to help you feminine, taking its role in the domestic financial stability and you will community creativity. – By strengthening women, the newest model just tackles poverty plus promotes gender equivalence. ## Ineen Bank is related to the imaginative means, tight management formations, and you can a focus on carried on learning and you can version. – The fresh design has changed to include electronic products, increasing its ability to meet the needs of your poor courtesy greatest study application. While the Grameen design might have been acknowledged because of its impact on impoverishment alleviation, particular ratings focus on possible overestimations of the effectiveness and you can inherent risks for the microfinance, such as credit exposure and you can reliance with the financing. Nonetheless, their values continue steadily to convince option economic possibilities international.