Working with the bankruptcy proceeding and you may seeking safe an FHA mortgage just after Part thirteen personal bankruptcy would be an emotional procedure. On this page, we shall become sharing exactly how bankruptcy and you will FHA lenders will likely be approved, with regards to the Part version, within one year. Keep reading to know how Individuals Bank Home loan can direct you from complete process and possess you well on your way with the viewing new light shining at the end of tunnel getting their FHA Financial.

Chapter 13 Bankruptcy and you can FHA Home loans

Brand new FHA lets a borrower in order to possibly become accepted to own a great financial throughout the Part thirteen personal bankruptcy considering the fresh new debtor made quick, confirmed repayments for at least one year although some loan providers requires all in all, 2 years immediately after discharged just before recognizing a different sort of financial. One of many fine print of FHA financing whilst in Section 13 is the borrower is not automatically able to sign up for good brand new FHA mortgage. The fresh judge trustee’s authored acceptance ‘s the qualifying condition of one’s the second policy. The latest borrower must provide an explanation of why they have been asking for good loan in their Chapter 13 Bankruptcy proceeding. At the same time the latest borrower need certainly to submit the FHA domestic loan application. To advance be eligible for the mortgage alone, the new borrower need to have high enough borrowing, a job, and also other monetary certificates.

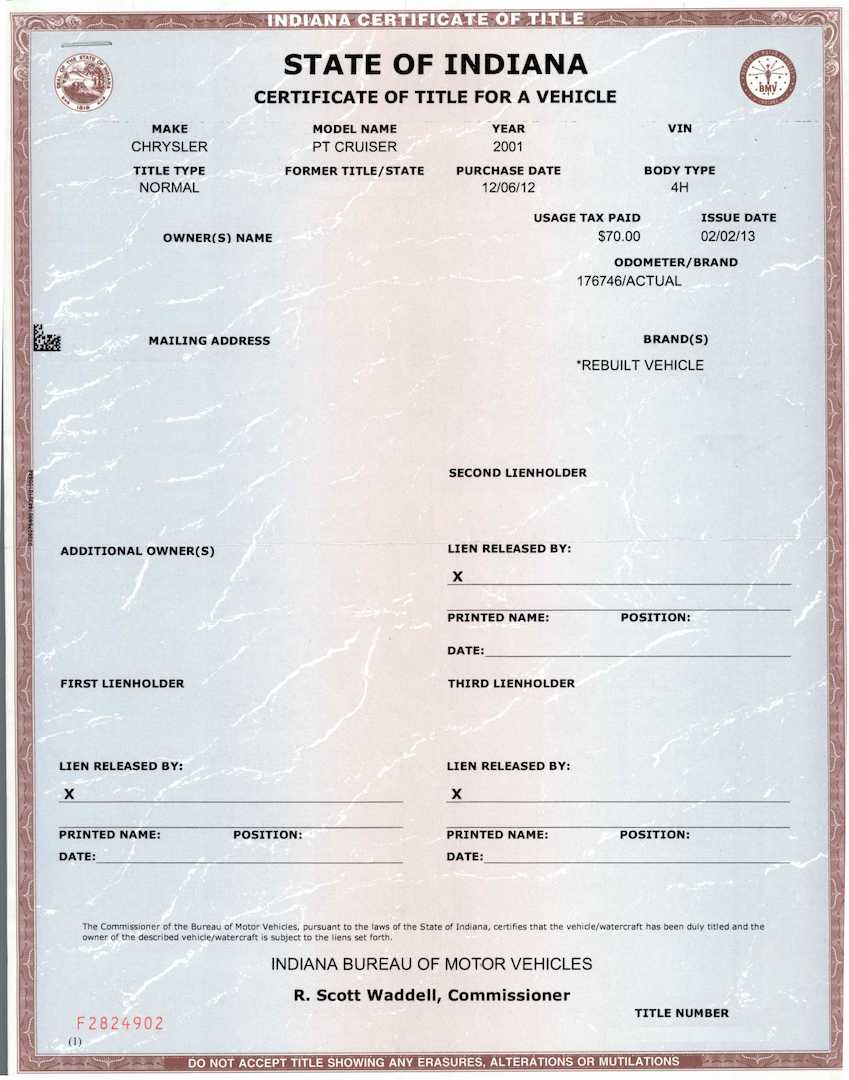

One of the largest difficulties with providing a keen FHA financial immediately following Part 13 case of bankruptcy, is the insufficient experience of the loan professionals employed in talking about difficulties aren’t occur within the loan procedure. New money from inside the bundle usually are difficult to make certain, and many of the items that have been stripped throughout the plan are not clear into FHA underwriters that have to approve brand new loan. Most other common problems try title discrepancies and you can bankruptcy proceeding related credit affairs which have developed throughout or pursuing the Section 13 bundle. It is vital to get a hold of a lender you to definitely understands an average problems and how to safely browse all of them.

Chapter 7 Personal bankruptcy and you may FHA Mortgage brokers

A bankruptcy proceeding Bankruptcy are quite unlike a section thirteen Personal bankruptcy since the a part seven Bankruptcy proceeding necessitates the borrower to go to inside the FHA’s seasoning period. This period of time is no less than couple of years, and additionally any additional time used from the financial immediately after assessment. Specific loan providers will demand a maximum of 36 months prior to applying for a unique home loan. Overall, a chapter seven Personal bankruptcy means a longer time period than a part 13 Case of bankruptcy timeline.

Any kind of Other Loans I’m able to Get Through the or Just after Personal bankruptcy?

You will find constantly most other loan vehicles which one get qualify for, the main is always to get acquainted with and that options are readily available and you will examine. FHA, Virtual assistant, USDA and many old-fashioned refi choices are usually the top possibilities to the reasonable pricing and more than positive words. Yet, most other tough money lenders are also available if the not one options are present. . We on Individuals Lender Financial would suggest so you can carefully look at the any and all of solution financing choices it’s possible to choose and rehearse the best guidance if you do affect like an alternate types of lending. All of our staff here at Individuals Lender Mortgage perform our very own top in order to strongly recommend the most proper financing to you personally most abundant in advantageous terminology you can easily.

Favor Peoples Lender Financial to simply help browse the fresh new FHA financing processes just after Bankruptcy proceeding

When you favor Peoples Lender Home loan in order to receive a keen FHA loan once Part 13 Case of bankruptcy, there are all of our possibilities to-be greatest-level and you will worried about taking visible results on most expedited format. Go ahead and e mail us for additional information on our very own FHA mortgages and other choices and exactly why you need to prefer us over most other communities within our globe. We’re going to be sure to answr fully your inquiry whenever possible. I look forward to reading from you in the loans in Shoal Creek near future!