Homeownership inside Pennsylvania not merely provides a spot to call home but also offers the opportunity to create equity. Whenever you are a homeowner trying power the fresh equity you’ve created, Home Equity Funds (He Money) and you may House Collateral Lines of credit (HELOCs) was strong economic devices to take on. In this guide, we’ll discuss the latest particulars of The guy Funds and you can HELOCs, getting information for Pennsylvania people keen on unlocking the significance for the their houses.

Knowledge House Guarantee

Domestic guarantee are a good homeowner’s demand for their property, representing the difference between the home’s market price while the the financial equilibrium. In the Pennsylvania, where assets thinking can experience motion, skills and you may leveraging that it security is vital to and come up with advised economic choices.

Regarding opening home equity, a few number one options are Domestic Equity Fund (He Loans) and House Guarantee Credit lines (HELOCs). The guy Fund offer a lump sum number having a fixed attention rate, leading them to perfect for planned expenditures such as for instance home home improvements. As well, HELOCs bring an excellent rotating credit line, giving independency getting lingering requires particularly knowledge costs otherwise unanticipated costs. Pennsylvania home owners should cautiously envision their economic needs before you choose anywhere between such choice.

Qualification Conditions internet installment loans Mississippi to possess The guy Finance and you may HELOCs when you look at the Pennsylvania

To help you qualify for He Fund or HELOCs during the Pennsylvania residents typically need a strong credit history, a reasonable personal debt-to-income ratio, and you may an adequate amount of collateral in their land. Regional loan providers, like those on Morty’s program, also provide personalized pointers based on private financial facts in addition to novel areas of the fresh new Pennsylvania real estate market.

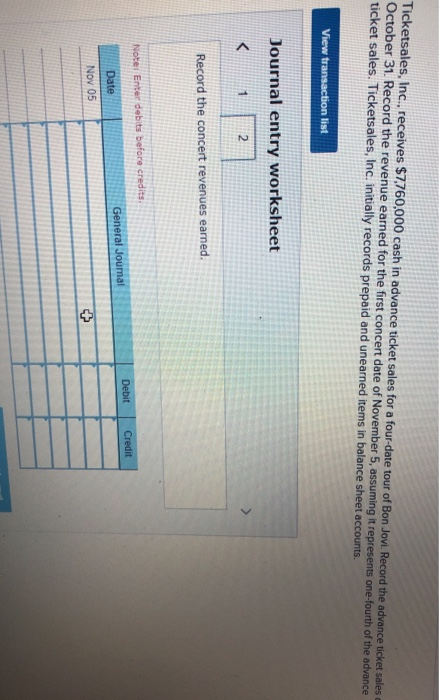

Simple tips to Sign up for He Funds and HELOCs

The application form techniques for The guy Loans and you may HELOCs comes to gathering papers, such as for instance proof money and property valuation. Pennsylvania owners will benefit off dealing with regional financing officers who understand the subtleties of your own country’s market. Morty, an on-line home loan brokerage, links borrowers that have regional mortgage officials, making certain a customized and you can effective software processes. That have Morty, people might even sense a swift closing, toward possibility to personal with the an effective HELOC into the very little since 14 days.

Determining Loan Wide variety and you may Rates of interest

The borrowed funds numbers and you can interest levels getting The guy Fund and you may HELOCs count on individuals activities, including the level of security, creditworthiness, and you can sector criteria. Pennsylvania property owners may benefit in the competitive pricing offered by local loan providers, especially when using on line systems such as Morty that streamline the credit procedure.

Common Ways to use He Finance and you can HELOCs

Pennsylvania people usually use The guy Funds otherwise HELOCs to have a selection out of motives. Out-of money home improvements so you’re able to combining higher-attract loans or layer degree expenditures, these economic tools deliver the liberty must go some economic desires.

Factors

While he Money and HELOCs promote high pros, it is critical for property owners to understand problems. In charge explore is key, and you may understanding the terms, possible alterations in rates, and the danger of foreclosure in case of percentage standard are essential. Regional mortgage officials, accessible because of Morty, offer suggestions for in control credit.

Unlocking home guarantee using The guy Money otherwise HELOCs in Pennsylvania need consideration and you will informed decision-and also make. Of the understanding the differences when considering these types of selection, consulting with regional financing officers, and ultizing on the web systems eg Morty, homeowners can be control its collateral to attain its financial requires sensibly. Consider, the main is always to fall into line these types of financial units together with your novel circumstances and you may fantasies.

If you wish to end up being produced in order to a community loan officer near you, perform an account towards Morty today! Zero tension, free, only high local assistance and support!