Article Advice

Regarding personal loans, there are numerous legitimate lenders and you will services readily available. Unfortuitously, there are also fraudsters trying to make use of customers. Into the 2022, scammers took nearly $8.8 mil off People in america, according to the Government Exchange Payment (FTC). To safeguard on your own away from people future worries, it’s important to look to have preferred indicators regarding personal loan cons.

Personal loan scams should be difficult to identify since there are various kinds of cons one target users. Commonly, these types of cons aim to access rewarding information that is personal in regards to you for example their Societal Cover amount or bank card count. Frauds also can were looking to availableness their bank accounts, recharging heavens-higher interest rates and charges or leading you to pay for an effective unsecured loan you may never get access to.

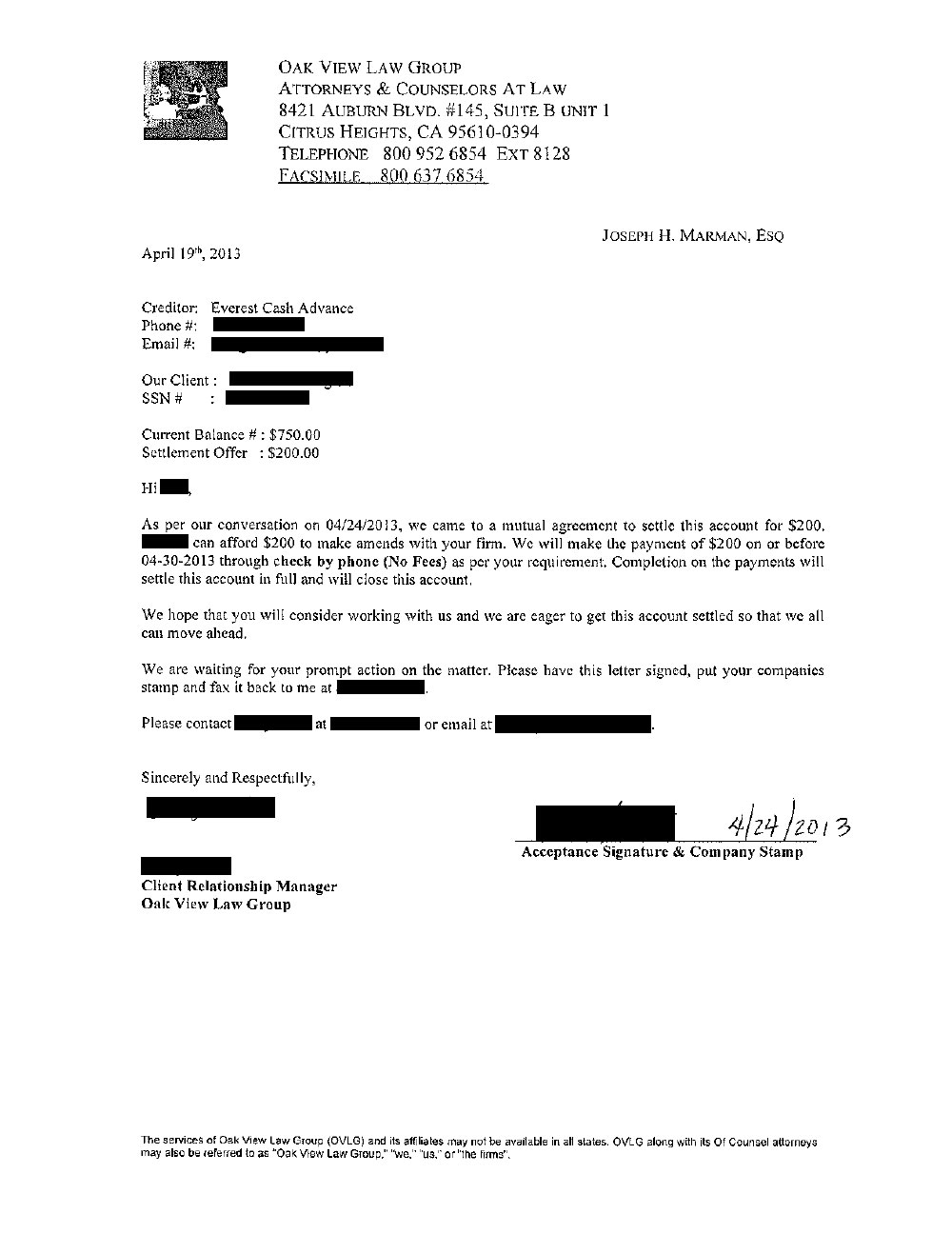

1. The financial institution requests for charges initial

An established financial will never request you to spend an upfront commission to access consumer loan loans or to remark personal bank loan records. In the event that a lender does require commission before you could availability their financing fund, this is almost always an indication of a fraud.

This is how unsecured loans performs: Once you repay a personal loan, you are doing so in the way of monthly installments. You’ll create steady improvements to the repaying the main balance and the focus charge.

2. The lending company guarantees you will be acknowledged before you apply

A publicity out-of protected recognition for a personal loan is another sign you to a lender may be seeking make the most of your. Generally, consumer loan lenders enjoys a small number of standards one to individuals you would like in order to satisfy to receive acceptance to possess an unsecured loan. Your credit history, money and many other things activities need certainly to satisfy a certain height from criteria getting a loan provider feeling comfy providing you a great personal loan.

You’ll find personal bank loan activities on the market making it possible for customers that have lowest credit ratings locate a personal mortgage, however, also those loans features conditions that really must be found. A promise out-of protected loan acceptance is oftentimes an indication of a beneficial subprime financing otherwise a whole fraud.

step 3. The lending company promises to clear your debt

In the event the a great deal music too-good to be real, they is frequently. A common exemplory case of an unsecured loan scam concerns guaranteeing in order to obvious your debt. This is done from the stating to collect financial obligation money under control so you’re able to pay a current way to obtain debt.

Steer clear of these now offers and instead functions yourself with your lender to see what possibilities you may have for making smaller progress on personal debt cost.

cuatro. The lender isn’t really inserted on your state

In the event that a lender isn’t inserted on your condition, they cannot legitimately offer you a personal loan. They must sign in in the states where it efforts its business. Prior to agreeing to any loan now offers, double-check that the lender is entered about state you live in.

This can be done by the calling a state lawyer general or financial otherwise economic qualities regulator. You will discover tips speak to your specific state’s financial regulator right here.

5. The lender calls your having an offer

An established unsecured loan bank fundamentally will not highlight their properties from the cold-contacting consumers and you will making them financing provide at that moment. And if a loan provider has reached out over you initially, this can be a sign of an effective scam artist seeking to get usage of your own personal financial pointers.

It is better habit not to ever answer loan providers otherwise creditors which leave you an offer from the cell phone, door-to-doorway solicitation paydayloancolorado.net/keenesburg or via mail. It’s actually illegal for a loan issuer to give financing over the telephone.

How to locate legitimate personal loan now offers

A consumer loan is actually an extremely of use monetary tool, very don’t let possible scams scare you faraway from borrowing from the bank currency for that gorgeous kitchen redesign. When the time comes to try to get a personal bank loan, these are particular things you can do to get an established financing lender.

- Prove the financial institution is entered on your condition: You can contact your condition lawyer standard or perhaps the nation’s financial otherwise monetary properties regulator to verify in the event the a loan provider is actually entered on your county. Consider – they can not legitimately question a loan if they commonly entered in order to do business from the condition you live in.

- Browse the lender’s on the internet critiques: When shopping for the best place to score a personal bank loan, viewpoints from other borrowers makes it possible to get a thought if the a loan provider was reliable or not. Check out Better business bureau (BBB) accounts and other authoritative feedback and study recommendations on line understand about consumer experiences.

- Investigate the fresh new lender’s on the internet presence: Do the financial institution has actually a site that’s easily accessible? Really does you to website without difficulty provide the important information and then make a choice in the a financing tool? In the event your financial does not have any an expert web site having perfect get in touch with home elevators it, which is a sign simply to walk out.

What direction to go if you think you happen to be being ripped off

If you suspect you’re employed in a personal loan con otherwise one to an effective scam artist attempted to address your, you can find actions you can take so you can report the private mortgage ripoff.

- Contact one people in it: Earliest some thing basic, for those who gave currency towards the scam artist easily get in touch with one organizations you caused to really make the fee such as your financial otherwise bank card providers. Whenever you, cancel one repayments and request assist protecting your own accounts.

- Document an authorities statement: Be sure to contact the authorities and document research. You should demand a copy of the police report to keep on hand to have evidence of the fresh experience.

- Be mindful of your credit: If your scammer has entry to determining factual statements about your that they can used to discover borrowing accounts on your own identity, this will undoubtedly wreck your credit rating. Sign up for borrowing keeping track of or imagine cold your own credit to end fraudulent conclusion.

- Manage a research toward FTC: To aid prevent the scammer away from hurting almost every other consumers regarding upcoming, document a summary of one thought personal bank loan frauds into FTC.