Home financing recast happens when you make a large one to-day payment to attenuate the home loan harmony and your lender recalculates your own monthly payment as a result. (This really is referred to as a re also-amortization of your own financing.) Their bank restructures your payment agenda throughout the loan title in order to take into account the swelling-sum fee.

Recasting their mortgage doesn’t alter your interest or mortgage words nevertheless can help decrease your requisite minimum payment web per month and it may save you money inside the notice along side lives of loan.

Not all loan providers offer recasting and not all of the financing systems is actually eligible. You can tend to create a lump-share payment to reduce your dominating harmony but in place of a great recast your monthly mortgage payment manage sit a comparable.

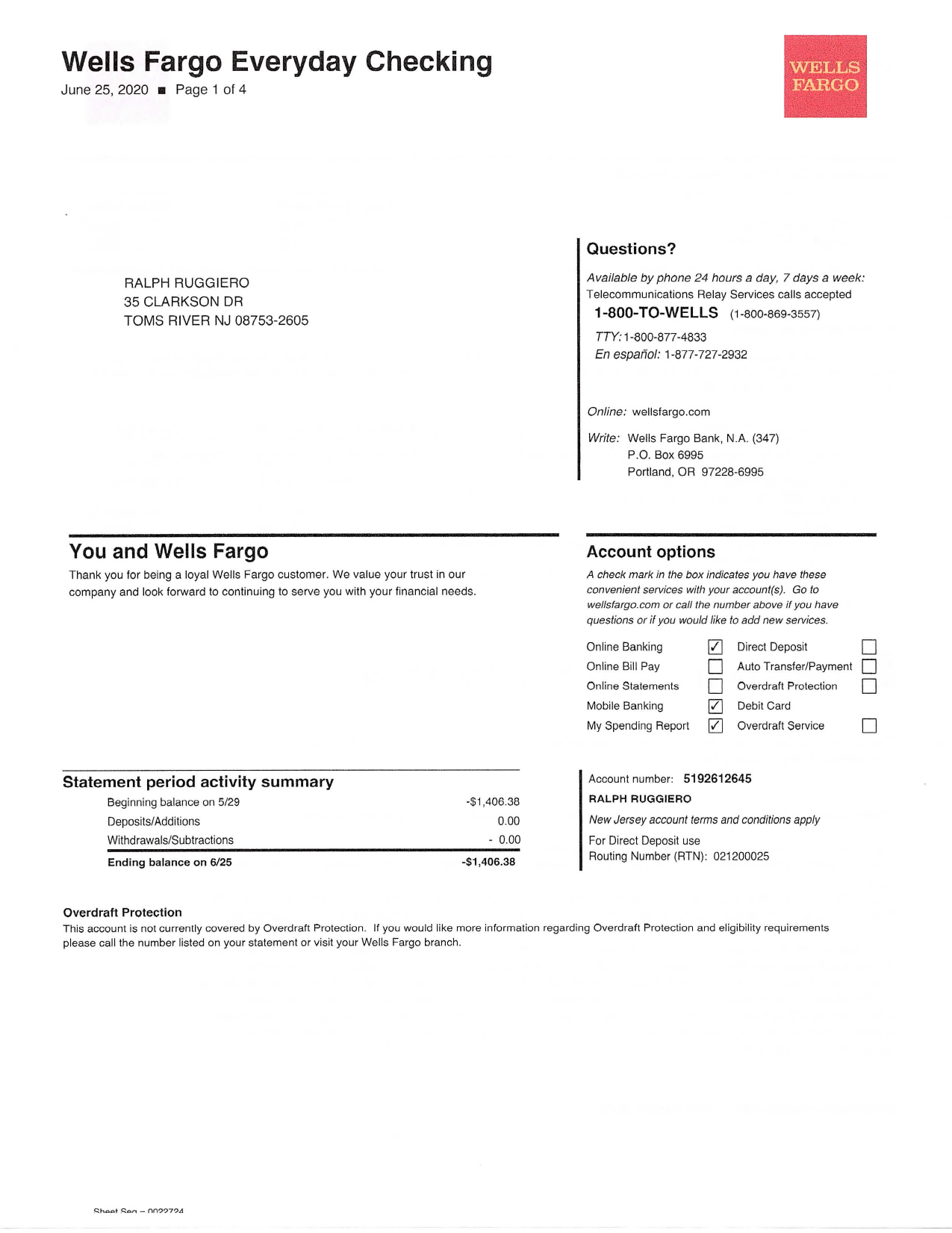

Mortgage recast example:

When determining whether or not to recast the mortgage, it has been best to go through the number to determine when the it is convenient. Check out this financial recast analogy.

Within analogy, the newest borrower could probably obtain lender to recast the financial and then have a different all the way down payment to have dominating and you can attention.

Can it be smart to recast your own financial?

Recasting the mortgage has actually positives and negatives. After you generate a large lump-sum percentage typically needed for mortgage recasting, you might decrease your payment per month and you can probably save very well desire costs. To make a lump-contribution commission setting you simply will not get that currency readily available for emergencies or any other expenses, however.

Along with, you can also believe and then make a lump-share commission one to reduces your principal equilibrium however recast your own mortgage and continue maintaining your monthly payment the same. The advantage of making a lump sum and you will maintaining your payment just like opposed to recasting the loan is this particular can get allow you to pay off the home loan quicker. By paying regarding their home loan shorter you can even probably save much more profit desire along the lifetime of the loan.

If you refinance otherwise recast their home loan?

Recasting and you may refinancing was both alternatives that may help you straight down their payment per month and you can save money on desire. Recasting requires that have a large amount of dollars to build a single-big date payment and will not will let you replace your attract speed and other financing terms and conditions, however.

Refinancing will give you the opportunity to lower your interest and you may possibly lower your percentage or save money on desire. Refinancing has no need for that possess most bucks while you will need to pay settlement costs and you should satisfy your own lender’s borrowing from the bank, earnings, and you may economic requirements to really get your re-finance acknowledged.

Thought one another possibilities and decide which is the best selection for your. And don’t forget by refinancing, the total loans charges you pay may be higher over the lifetime of the mortgage.

How many times can you recast your home loan?

Discover generally maybe not a threshold so you can how many times your is also recast your home loan, however, recasting the home loan usually boasts a charge. It fee is several hundred bucks and may feel factored in the decision to recast. If you have currently recast the mortgage, you will be capable pay off their mortgage early by utilizing your more offers to expend off the mortgage prominent.

Recasting having Freedom Mortgage

Have you been a current Independence Home loan customers that have questions regarding whether you are entitled to recast their home loan? Va, FHA, and you will USDA money are not entitled to recasting. Conventional financing can be eligible for people who fulfill the needs. Label one of our Customer care Representatives on 855-690-5900 to go over recasting.